U.S. Digital Ad Revenues Surpass $100 Billion Mark For The First Time, Hitting Landmark $107.5 Billion In 2018, According To Iab Internet Advertising Revenue Report

Record-Breaking Digital Marketing Spend Represents 22% Year-Over-Year Growth

NEW YORK, NY (10 May 2019)

U.S. digital advertising revenues in 2018 reached an all-time historic high of $107.5 billion—exceeding the $100 billion mark for the first time—according to the latest IAB Internet Advertising Revenue Report released by IAB and prepared by PwC US. This full-year 2018 total represents a 22 percent year-over-year increase from $88.3 billion in 2017.

Mobile and video continue to lead digital marketing’s steady growth. Accounting for nearly two-thirds (65%) of 2018’s internet ad revenues, mobile reached $69.9 billion, up 40 percent from the previous year at $50.1 billion. Advertising revenues from digital video saw the largest rise among all formats—an uptick of 37 percent—catapulting to $16.3 billion in 2018 from $11.9 billion in 2017.

The report analyzes the drivers behind the dramatic growth, identifying that revenue stemming from eCommerce, including the emergence of the direct brand economy, has played a key role. With the rise of “social stories” as a tool to connect with today’s consumers, social media was also pinpointed as motivating factor in significant investment—with storytelling now catching fire across platforms and brands. In addition, technological advances, ranging from virtual reality to voice to 5G, were recognized as drivers and expected contributors to a continued robust advertising environment.

Other highlights from the report include:

- Digital video on mobile devices continued its momentum, reaching $10.2 billion in full-year 2018, a 65% rise from full-year 2017 at $6.2 billion

- Digital video ad revenues on mobile devices comprised 63% of all digital video ad revenues in 2018, up from 52% in the prior year

- Digital audio advertising grew 23% to reach $2.3 billion, outpacing last year's full-year revenue of $1.8 billion

- Social media revenue rose to $29 billion in 2018, an increase of 31% from $22.1 billion in the previous year

"Surpassing $100 billion in annual revenue is a watershed moment for the digital advertising ecosystem—one built on its power to build direct relationships between brands and today’s consumers,” said Randall Rothenberg, CEO, IAB. “Innovative platforms like over-the-top television, podcasts, virtual reality, and augmented reality all have the potential to help marketers forge even stronger ties with audiences, as brands navigate the new ‘consumer first’ playing field.”

“Digital marketing has unequivocally secured the lead in media market share, just as it has taken the lead in consumer mindshare,” said Anna Bager, Executive Vice President of Industry Initiatives, IAB. “As audiences have shifted away from traditional media, digital has been a dominant force in capturing their attention—first from desktop to mobile devices and more recently to connected TV, smart speakers, and digital out-of-home.”

"Advertisers are placing a premium on mobile and video, and in turn, the two are fueling the ongoing rise of digital marketing,” said Sue Hogan, Senior Vice President, Research and Measurement, IAB. “And the 5G promise of lightning fast speed and decreased latency presents opportunities for businesses and consumers alike: a smoother user experience, which could further consumer ease with use and frequency of ecommerce on small screens; and it would allow for greater innovation in ad formats. As companies prepare for 5G—and its rollout gains momentum—we can anticipate even more healthy digital growth.”

“Year after year, brands have been increasing their commitment to digital as a primary channel to reach consumers,” said David Silverman, Partner, PwC US. “The analysis in this report highlights important drivers and trends that could influence interactive’s trajectory in the years to come, as marketers look to new formats and technologies to help them connect with consumers."

| Revenue (Ad Formats) |

Full Year 2017 |

Full Year 2018 |

| |

% |

$ |

% |

$ |

| Search (Mobile and Desktop) |

46% |

$40,630 |

45% |

$48,442 |

| Banner (Mobile and Desktop) |

31% |

$27,491 |

31% |

$33,499 |

| Sponsorships |

1% |

$824 |

1% |

$996 |

| Rich Media |

3% |

$2,509 |

3% |

$2,979 |

| Ad banners / display ads |

27% |

$24,158 |

27% |

$29,524 |

| Digital Video Commercials (Mobile and Desktop) |

13% |

$11,863 |

15% |

$16,274 |

| Other (Mobile and Desktop) |

9% |

$8,281 |

9% |

$9,273 |

| Classifieds and Directories |

4% |

$3,354 |

3% |

$3,750 |

| Lead Generation |

3% |

$2,953 |

3% |

$3,148 |

| Audio |

2% |

$1,831 |

2% |

$2,251 |

| Other (Mobile Other) |

0% |

$142 |

0% |

$122 |

| |

|

|

|

|

| Total |

100% |

$88,265 |

100% |

$107,487 |

| Revenue (Desktop v Mobile) |

Full Year 2017 |

Full Year 2018 |

| |

% |

$ |

% |

$ |

| Desktop |

43% |

$38,204 |

35% |

$37,559 |

| Mobile |

57% |

$50,061 |

65% |

$69,928 |

| |

|

|

|

|

| Total |

100% |

$88,265 |

100% |

$107,487 |

| Revenue (Pricing Models) |

Half Year 2017 |

Half Year 2016 |

| |

% |

$ |

% |

$ |

| Impression-based |

33.9% |

$29,881 |

35% |

$37,528 |

| Performance-based |

62.3% |

$54,973 |

62% |

$66,382 |

| Hybrid |

3.9% |

$3,411 |

3% |

$3,576 |

| |

|

|

|

|

| Total |

100% |

$88,265 |

100% |

$107,487 |

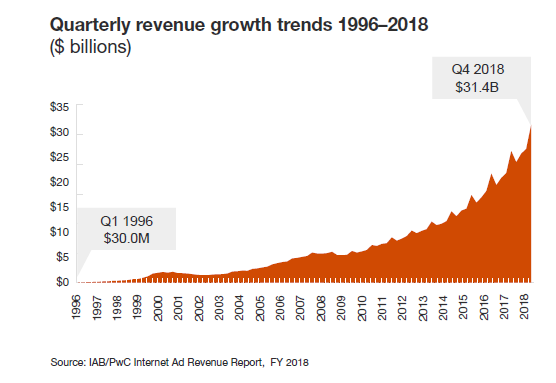

The following chart highlights quarterly ad revenue since IAB began measuring it in 1996; dollar figures are rounded.

IAB sponsors the IAB Internet Advertising Revenue Report, which is conducted independently by the New Media Group of PwC. The results are considered a reasonable measurement of interactive advertising revenues because the data is compiled directly from information supplied by companies selling advertising on the internet. The survey includes data concerning online advertising revenues from web sites, commercial online services, free email providers, and all other companies selling online advertising.

PwC does not audit the information and provides no opinion or other form of assurance with respect to the information. Past reports are available at www.iab.com/adrevenuereport.

About PwC US

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 158 countries with more than 236,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com.?

©2019 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

About IAB

The Interactive Advertising Bureau (IAB) empowers the media and marketing industries to thrive in the digital economy. Its membership is comprised of more than 650 leading media and technology companies that are responsible for selling, delivering, and optimizing digital advertising or marketing campaigns. The trade group fields critical research on interactive advertising, while also educating brands, agencies, and the wider business community on the importance of digital marketing. In affiliation with the IAB Tech Lab, it develops technical standards and best practices. IAB and the IAB Education Foundation are committed to professional development and elevating the knowledge, skills, expertise, and diversity of the workforce across the industry. Through the work of its public policy office in Washington, D.C., IAB advocates for its members and promotes the value of the interactive advertising industry to legislators and policymakers. Founded in 1996, the IAB is headquartered in New York City and has a San Francisco office.